The Greatest Money News You’ll Hear All Year: Investing Can Be Ridiculously Easy

Some money realities bite. Hard. The majority of people don’t make a living wage. The financial crisis of ten years past disproportionally dicked over millennials. Credit cards destroy lives. Student loans are a ridiculous burden for young people. Religiously saving money feels like eating a permanent shit sandwich (while spending money tastes like gold-leafed gummy bears).

Sometimes I just wanna throw my arms up in the air, cause a scene, and say to hell with it all.

Well, do I ever have news that will send tingles straight down to your nethers:

When it comes to investing, the EASIEST method is the BEST method.*

*At least, historically.

Wait a minute, the easy way is the best way? That pretty much NEVER happens! Not with most money-related decisions, or health decisions, or dating, or cleaning your apartment—really anything! REJOICE, EARTHLINGS!

What I am going to explain to you below should be the single-greatest piece news you’ve heard about money all year—perhaps your entire existence. Thanks, World, for cutting us this one break! (Said as I gaze upon a pile of socks, perplexed that there are no matches.)

Investing in Stocks

Let’s assume you decide to invest 80% of your long-term (retirement) moola in the stock market. (To determine how much money you should have in stocks, read this.) So then the follow-up question is how do I do that? How do I invest that 80% in stocks? Do I go out and handpick my own companies? Do I just randomly select a bunch of different funds from my list of 401(k) options?

Well, only if you want to do WORSE than the stock market’s average performance. Seriously. If you just owned a little bit o’ everything, in the exact same proportion of the big ol’ market, there’s an overwhelming chance you’d do way better than picking your own stocks or even your own hodgepodge of funds. And to do this, you can simply buy one or two index funds—and that’s literally it.

The latest studies show that over 90% of investment managers—PAID PROFESSIONALS whose MAIN FREAKING JOB is to pick the “best” investments—perform worse than the stock market’s average. (That includes fund managers—more on this below.)

Normals who try to invest on their own by picking their own stocks and even stock funds do just as bad, if not worse. Studies show that Normals earn less than 4% a year doin’ it on their own. The stock market has averaged over 10%. You really have to be pooping the bed to miss the market average by 6-7%, and that’s precisely what Normals AND even some investment managers do.

(Exactly why this is the case is a topic for a whole ‘nother blog post, but suffice it to say that people are too emotional with investing—like being enticed into buying and selling at the wrong times. Yes, even you, cutie pie.)

First, the difference between an index and an index fund

An index is a measuring stick; the S&P 500 or the Dow Jones, for example, were both created for the sole purpose of measuring the stock market’s performance. That’s it! The S&P 500 is the most popular measure of how the United States’ stock market is performing because it measures the 500 “leading” (mostly the biggest) companies. I’ll repeat once more: it’s just a measure of performance.

Therefore, an index fund invests and performs exactly as the index that it tracks. That means an S&P 500 Index Fund is built to mimic the S&P 500 Index, which as we now know, is considered a pretty great measure of the United States’ stock market. You would buy an S&P 500 or similar index fund because you wanted to get broad, diversified, and cheap exposure to the United States stock market.

An index fund, like an S&P 500 index fund, is passive, which means that no one “actively” manages the stocks held within the fund. It just does whatever the stock market does. (Which historically, has been hella generous at ~10% a year.) Nothing more, nothing less.

What is a Fund? Two Types

Let’s take a quick step back: What is a fund? A fund is a big basket of investments, whether that basket is full of stocks or bonds or real estate or whatever. Mutual funds were designed to give investors without a lot of money the opportunity to invest in lots of different things by pooling their money with other investors. (Just think about what the word mutual means!)

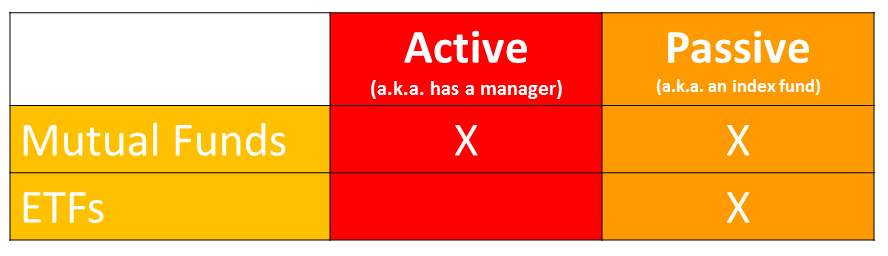

Nowadays, there are two types of funds: mutual funds and exchange-traded funds (ETFs). The two are constructed differently, but at their cores, they each provide you with the same service: access to lots of investments with one click of a button.

ETFs are generally always index funds. This is not the case for mutual funds. And because it is most likely that you only have access to mutual funds in your 401(k) through work, let’s talk about the other “style” of fund: actively-managed funds. STAY WITH ME HERE, FOLKS!

UPDATE: More and more actively managed ETFs are hitting the market. Whether you buy an ETF or a mutual fund, you have to know whether it’s managed or indexed.

Active Versus Passive

Mutual funds come in two flavors: active and passive. Passive = no manager = index funds.

Active management, on the other hand, means that there’s some highly-overpaid professional in a starched collar making decisions about what is held within the fund—buying this stock, selling that stock, rubbing one out under his big oak desk. FRIENDS, I LOVE YOU AND THEREFORE I NEED FOLLOWING TRUTH TO REVERBERATE WITHIN YOU: The ONLY reason you trade stocks or actively manage is because you think you can BEAT the stock market average.

Otherwise, you’d just buy an index fund for cheap AF and just return the damn average!

Like I said earlier, actively managed mutual funds underperform the stock market average over 90% of the time. And if that’s not bad enough—they charge you a fee to LOSE to the stock market. And even a .5% or 1% fee, which seems like nothing on paper, can amount to thousands of dollars over time. Ya know how us finance peeps are always yapping about how returns compound? Well, fees compound too.

All of this is not to say that no one can ever outperform the stock market. Managers can, and individual investors can. But it’s rare and fleeting, and finding that manager at the right time is like finding True Love on Tinder—possible only with some insane luck. Investing success is *valley girl voice* so fucking rannndddom—and I mean that statistically, not metaphorically.

So, what do you do if you want to have a portfolio that performs in the top 10% of all investors? Invest in simple index funds, whether index mutual funds or exchange-traded funds, and let that shit ride. No spreadsheets, no comparing managers, no deciphering market signals, no making complete fucking guesses about how to invest. Seriously, it’s that easy.

Then, look at your investments as little as humanly possible. Be lazy. Seriously, take the easy way out. Eat Cheetos out of your belly button, watch Game of Thrones for weekends on end, and don’t think about your investments again for the next couple years. (As long as you’ve got that automatic contribution and automatic investing all set up, of course.)

For more information on index funds, please, I BEG OF YOU, listen to this podcast. Every single adult should understand every.single.goddamn. word of this.

The Caveats

Of course, humans are able to ruin even good and simple things. Just look at cell phones, the environment, and the original Real World if you need any evidence. Therefore, the caveats to index investing on your own:

1. Commit for the long term. Think 20+ years, but 30, 40, and 50 is better.

2. Remain chill in both times of crisis and excitement. Don’t try to time anything. Consistently put money into the stock market no matter what the news tells you is happening. (Remember, times of crisis are generally the best times to invest!)

3. Don’t switch shit around. Just stick with your allocation of index funds, whether it’s all one U.S. stock index fund or a combo of one U.S. stock index fund and one foreign fund. For example, I basically do 50% in one US stock index fund and 50% in one foreign index fund.

4. Rebalance occasionally. Once per year or every other year, check your account and reallocate your US and foreign back to what you had initially determined would be your special sauce—so for me, 50/50. This means selling some shares off the better performing of the two (or three or whatever) and reinvesting that money in the lesser performing of the two. It’s counterintuitive, selling off the better performing of the two or three, but it promotes good investor behavior: sell high, buy low. Rebalancing should take 15 minutes, once every year or so.

THEM’S THE RULES, YA HEAR?

Money is notoriously hard, so take advantage of how it can be easy in this one huge way.

Want to learn EVEN MORE about investing? Sick of trying to cobble together a complete education using blog posts and online resources? Take my online Invested Development course. It’s Investing 101, but fun, actionable, and a COMPLETE education. Finally, feel confident in your investing plan and knowledge! Read more about it here.